Spesen

Inhaltsverzeichnis

- Grundlegendes

- Einrichtung

- Speseneditor

- Exportieren der Spesen

- Gesetzliche Regelungen für Deutschland

- Tätigkeitsstätten

- Spesenprofile

- Ländersätze

Das Spesenmodul dient zur vollautomatischen Ermittlung der Spesen der Mitarbeiter Ihrer Firma mit Hilfe der Positionsdaten der Fahrzeuge.

Grundlegendes

Spesen fallen an, wenn der Mitarbeiter im Auftrag seiner Firma eine Tätigkeit ausführen muss, welche außerhalb seiner regelmäßigen Arbeitsstätte (Tätigkeitsstätten) liegt. Des Weiteren darf sich der Arbeitnehmer dabei auch nicht an seiner privaten Adresse aufhalten. Diese Zeit wird als Abwesenheit bezeichnet.

Der Gesetzgeber veröffentlich jährlich Listen mit Kostensätzen pro Land und teilweise Region für den Verpflegungsmehraufwand. Diese werden als Grundlage für die Berechnung der Spesensätze genutzt. Die neuen Auslands - Spesensätze für das Jahr 2026 sind hinterlegt gemäß: https://www.bundesfinanzministerium.de/Content/DE/Downloads/BMF_Schreiben/Steuerarten/Lohnsteuer/2025-12-05-steuerliche-behandlung-reisekosten-2026.pdf?__blob=publicationFile&v=4

Zur Ermittlung der Spesen werden Angaben über die erste Tätigkeitsstätte oder die private Adresse ( Hauptwohnsitz ) benötigt.

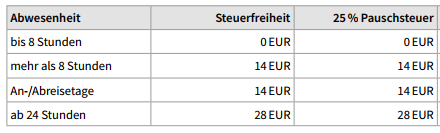

Die Spesensätze werden unterteilt in:

- Abwesenheit über 8 Stunden

- An- und Abreisetag (unabhängig von der Zeit)

- Abwesenheit von 24 Stunden

- Übernachtung

Derzeit unterstützt das Spesenmodul nur die gesetzlichen Regelungen für Unternehmen mit Firmensitz in Deutschland.

Die Ermittlung der Spesensätze erfolgt jeweils nachts bis vorgestern.

Einrichtung

Um Spesen für Ihre Firma ab sofort vollautomatisch erstellen zu können, müssen Sie die Angaben zum Hauptwohnsitz und der ersten Tätigkeitsstätte für Ihr Personal hinterlegen. Außerdem können Sie weitere Tätigkeitsstätten/Ausnahmen definieren, an denen die Abwesenheit im Sinne der Spesen unterbrochen wird. Erstellen und Verwalten von Tätigkeitsstätten wird im Kapitel 'Tätigkeitsstätten' beschrieben. Zum Aktivieren der Spesen müssen Sie die Personaldaten des entsprechenden Mitarbeiters bearbeiten. Klicken Sie auf 'Spesenabrechnung aktivieren'. Danach wählen Sie eine bereits definierte Tätigkeitsstätte aus und weisen ihr eine entsprechende Gültigkeit zu. Ab dem Zeitpunkt werden für diesen Mitarbeiter die Spesen ermittelt.

Sie haben die Möglichkeit die Tätigkeitsstätten für mehrere Mitarbeiter in einem Arbeitsschritt festzulegen. Dazu markieren Sie die entsprechenden Mitarbeiter. Durch Anklicken dieses Symboles  öffnet sich ein Assistent zum Festlegen der Tätigkeitsstätten.

öffnet sich ein Assistent zum Festlegen der Tätigkeitsstätten.

Speseneditor

Nach Auswahl von Fahrer und Zeitraum werden die Spesensätze eines Mitarbeiters für maximal 31 Tage tabellarisch angezeigt. Jede Zeile enthält die Spesen für einen Tag. Tage ohne Spesen werden grau dargestellt. Die Tabelle stellt folgendes dar:

- Tag des Spesensatzes

- Begin und Ende der längsten Abwesenheit des Tages

- die Dauer dieses Zeitraumes

- die in diesem Zeitraum verwendeten Fahrzeuge

- die Region für welche der Mitarbeiter Spesen erhält, durch Anklicken des Symboles

erhält man eine Übersicht über alle Grenzübertritte des Tages

erhält man eine Übersicht über alle Grenzübertritte des Tages - Kosten für Verpflegung und Übernachtung

- die anteiligen Steuersätze (steuerfrei, pauschalversteuert und steuerpflichtig) auf die Verpflegungskosten

- Berechnungsbasis nach Einstellung

- Freifeld ( zB für einen manuell einzutragenden Übernachtungsbeleg)

Bei Einträgen welche mit *1 versehen sind, gibt es an diesem Tag einen zweiten spesenrelevanten Zeitraum. Fährt man mit der Maus über diese Markierung, bekommt man den Zeitraum angezeigt.

Bei Einträgen welche mit *2 versehen sind, wurde an diesem spesenberechtigten Tag kein Fahrzeug genutzt

Bei Einträgen welche mit *3 versehen sind, bezieht sich die Berechnung zu den Steueranteilen nicht auf einen ganzen Monat.

Bei Einträgen welche mit *4 versehen sind, liegt der Auswertungszeitraum vor der Möglichkeit sich die Steueranteile ausgeben zu lassen (ab 01.01.2023).

Aktionen

| Icon | Aktion |

|---|---|

| Manuelles Bearbeiten eines Spesensatzes in einem Editor |

| Löschen des Spesensatzes |

| Tageweise Darstellung der Tagesroute des Fahrers in der Karte. Dabei wird der spesenrelevante Teil in blau angezeigt. |

| Anzeigen aller manuell durchgeführten Änderungen |

| Abwesenheitszeiten listen |

| + | Abwesenheit (im Sinne des Abwesenheitsmanagements) hinzufügen |

Spesensatz bearbeiten

Ist eine manuelle Änderung der Angaben eines Spesensatzes erforderlich, können Sie diesen im Editor bearbeiten.

Die Abwesenheitsart bestimmt den gesetzlichen Pauschbetrag, welcher für die Berechnung der Steueranteile auf die Verpflegungskosten herangezogen wird.

Nach Änderung des Zeitraumes oder der Region wird die ‚Spesenanpassung Firma‘ aktualisiert angezeigt. Diese Werte werden für den Mitarbeiter übernommen, falls noch keine manuelle Anpassung vorgenommen wurde.

Des Weiteren kann ein Übernachtungsbeleg hinzugefügt werden.

Nach dem Speichern der Änderungen wird der Spesensatz aktualisiert in der Tabelle dargestellt.

Exportieren der Spesen

Im Speseneditor können Sie die aktuelle Ansicht als PDF, Excel oder CSV exportieren. Im Berichtscenter haben Sie die Möglichkeit Serien zu generieren und die Spesen als HTML, PDF, Excel oder CSV zu exportieren.

Der generierte Bericht enthält eine Zusammenfassung der Kosten gegliedert in Gesamtkosten, Verpflegung sowie Übernachtung für den gewählten Zeitraum. Des Weiteren erhalten sie eine Auflistung aller Tage an welchen Spesen angefallen sind mit den gleichen Angaben wie im Speseneditor. Über eine Checkbox kann ausgewählt werden, ob die Steuerdaten im Bericht mit ausgegeben werden.

Gesetzliche Regelungen für Deutschland

Abwesenheitsarten

| Regel | Erläuterung |

|---|---|

| Abwesenheit | bedeutet, dass der Arbeitnehmer vom Arbeitgeber den Auftrag bekommen hat, eine Tätigkeit auszuführen, bei welcher er sich außerhalb der ersten Tätigkeitsstätte aufhält. Desweiteren darf sich der Arbeitnehmer dabei auch nicht an seiner privaten Adresse aufhalten. |

| Voller Spesensatz/ 24 Stunden Abwesenheiten | wird gezahlt, wenn die Abwesenheit 24 Stunden beträgt. |

| Reduzierter Spesensatz/ > 8 Stunden bzw. An-/Abeise | wird gezahlt, wenn die Abwesenheit größer 8 Stunden ist. Desweiteren bei An- und Abreise Tagen. Das sind Tage vor oder nach ganztätigen Auswärtsaufenthalten. An diesen Tagen wird der reduzierte Spesensatz gezahlt unabhängig von der Dauer der Abwesenheit. |

| Mitternachtsregelung | Wenn eine Auswärtstätigkeit über Mitternacht erfolgt und max. 16 Stunden lang ist. Diese Abwesenheit ist dem Kalendertag mit der überwiegenden Abwesenheit hinzuzurechnen. |

Steuerthematik

Die gesetzlichen Spesen sind steuerfrei. D.h. erhält der Arbeitnehmer (AN) zB bei einer Abwesenheit von über 8 Stunden 14 EUR muss weder der AN noch der Arbeitgeber (AG) darauf Steuern bezahlen. Gibt es im Betrieb aber individuelle Spesensätze, die über den gesetzlichen Werten liegen, sind diese zu versteuern. Für Verpflegungsmehraufwände bis zum doppelten steuerfreien Verpflegungsmehraufwand gilt eine Pauschalversteuerung von 25 Prozent. Alles was darüber hinausgeht, muss regulär versteuert werden.

Gesamterstattungsverfahren

Der AN erhält i.d.R. nicht nach jeder Fahrt seinen Spesensatz, sondern es werden monatlich die Fahrten betrachtet, d.h. die Spesen addiert und dann ausgezahlt. Ob Steuern anfallen und wenn ja wie hoch, bezieht sich demnach auf die Summe der gezahlten Spesen. Man rechnet somit die gesetzlichen Pauschalen zusammen und zieht sie in den Vergleich mit den individuellen Spesensätzen. Erst wenn die Summe der individuellen Spesensätze die Summe der gesetzlichen Pauschalen übersteigt, fallen Steuern an. In welcher Höhe entscheiden die verbleibenden Beträge. D.h. steuerfreie bzw. pauschal zu versteuernde Überbeträge werden über den Betrachtungszeitraum aufgehoben und verfallen nicht. Dies nennt man Gesamterstattungsverfahren.

Beispiel

Ein Arbeitnehmer (AN) erhält für eine 3-tägige Reise pro Tag 30,00 €, was insgesamt 90,00 € ergibt. Laut den gesetzlichen Pauschalen sind bis zu 56,00 € steuerfrei. Diese setzen sich wie folgt zusammen: 14,00 € für die An- und Abreisetage und 28,00 € für einen vollständigen Tag der Abwesenheit. Das bedeutet, dass von den insgesamt 90,00 € maximal 56,00 € steuerfrei ausgezahlt werden können. Zusätzlich kann derselbe Betrag (56,00 €) pauschal versteuert ausgezahlt werden. Da der Arbeitnehmer bereits 56,00 € steuerfrei erhält, bleiben 90,00 € - 56,00 € = 34,00 € übrig, die pauschal versteuert werden können.

Besonderheit:

Ein Zeitraum, der nicht spesenberechtigt ist (beispielsweise eine Abwesenheit von weniger als 8 Stunden), fällt nicht unter die gesetzlichen Spesenregelungen. Wird hierfür dennoch eine Zahlung vorgenommen, ist diese vollständig steuerpflichtig.

| Verpflegungskosten | steuerfrei | max. steuerfrei möglich | 25% pauschal | max. pauschal möglich | steuer- pflichtig | |

| 1. Tag Anreise | 30,00 | 14,00 | 14,00 | 14,00 | 14,00 | 2,00 |

| 2. Tag 24h | 30,00 | 28,00 | 28,00 | 2,00 | 28,00 | 0,00 |

| 3. Tag Abreise | 30,00 | 14,00 | 14,00 | 14,00 | 14,00 | 0,00 |

| 4. Tag 6h abwesend | 30,00 | 0,00 | 0,00 | 0,00 | 0,00 | 30,00 |

| Summe | 56,00 | 56,00 | 30,00 | 56,00 | 32,00 | |

| Gesamterstattung | 120,00 | 56,00 | 34,00 | 30,00 | ||

Tätigkeitsstätten

Unter diesem Punkt können Sie Tätigkeitsstätten anlegen und verwalten. Beim Anlegen einer neuen Tätigkeitsstätte können Sie dieser eine passende Bezeichnung vergeben.

Desweiteren stehen folgende Optionen zur Verfügung:

| Option | Erläuterung |

|---|---|

| Radius | Legt die Größe des Wirkungskreises dieser Tätigkeitsstätte fest. |

| Unterbrechung der Abwesenheit ab | sofort, 30 Minuten, 1 Stunde… Legt fest, wie lange sich das Fahrzeug in der Tätigkeitsstätte aufhalten darf, ohne das die Abwesenheit im Sinne der Spesen unterbrochen wird. |

| Art der Tätigkeitsstätte | Es wird die Art der Tätigkeitsstätte festgelegt. ( Hauptwohnsitz, Erste Tätigkeitsstätte, Weitere Tätigkeitsstätte ) |

Tätigkeitsstätten können nachträglich bearbeitet werden. Die Änderungen wirken sich sofort auf die Spesenberechnung der zugewiesenen Fahrer aus. Alle Änderungen kann man in einer Historie einsehen.

Auf der Seite „Karte“ werden alle Tätigkeitsstätten mit ihrem festgelegten Radius im Überblick dargestellt.

Auf der Seite „Zuweisungen“ kann man die Tätigkeitsstätten einzelnen oder mehreren Fahrern zuweisen oder die Zuweisung wieder aufheben.

Zuweisung

Zuweisungen der Tätigkeitsstätten zum Fahrpersonal können ebenso über die Personalverwaltung vorgenommen werden. Dort werden die angelegten Tätigkeitsstätten in einer Auswahlbox angeboten. Beim Hauptwohnsitz besteht die Möglichkeit, dass man eine Tätigkeitsstätte auswählt oder diese neu anlegt.

Eine Zuweisung zu einer Tätigkeitsstätte kann erst ab dem Datum erfolgen, an dem diese Tätigkeitsstätte erstellt wurde. Wird beispielsweise am 01.01.2025 eine Tätigkeitsstätte angelegt, kann ein Fahrer nicht zu einem früheren Datum dieser Tätigkeitsstätte zugeordnet werden.

Wird die Tätigkeitsstätte am 01.02.2025 erneut geändert, kann der Fahrer rückwirkend weiterhin bis zum 01.01.2025 zugewiesen werden.

Grundsätzlich darf eine rückwirkende Zuweisung jedoch maximal drei Monate zum jeweiligen Monatsersten erfolgen. Das bedeutet: Am 01.12.2025 kann ein Fahrer höchstens bis zum 01.09.2025 einer Tätigkeitsstätte zugewiesen werden.

Vorgabewerte für neue Tätigkeitsstätten

Unter Einstellungen im Spesenmodul können Sie unter Tätigkeitsstätten Werte definieren, welche bei der Erstellung von Tätigkeitsstätten als Grundwert vergeben werden soll.

| Regel | Erläuterung |

|---|---|

| Vorgabewert für den Radius einer Tätigkeitsstätte | Der Radius der Tätigkeitsstätte legt fest, in welchem Umkreis um die festgelegte Position eine Unterbrechung der Abwesenheit im Sinne der Spesen stattfindet. Befährt oder durchfährt das Fahrzeug diesen Bereich, wird die Spesenzeit unterbrochen. Ausgewertet wird der längste Abwesenheitszeitraum eines Tages. |

| Unterbrechung der Abwesenheit ab | Es kann eine maximale Aufenthaltszeit für eine Tätigkeitsstätte festgelegt werden. In dieser Zeitspanne kann sich ein Fahrzeug somit in der jeweiligen Tätigkeitsstätte aufhalten, ohne dass die Abwesenheitszeit im Sinne der Spesen unterbrochen wird. Bei jedem Befahren der Tätigkeitsstätte steht die komplette Unterbrechungszeit zur Verfügung. |

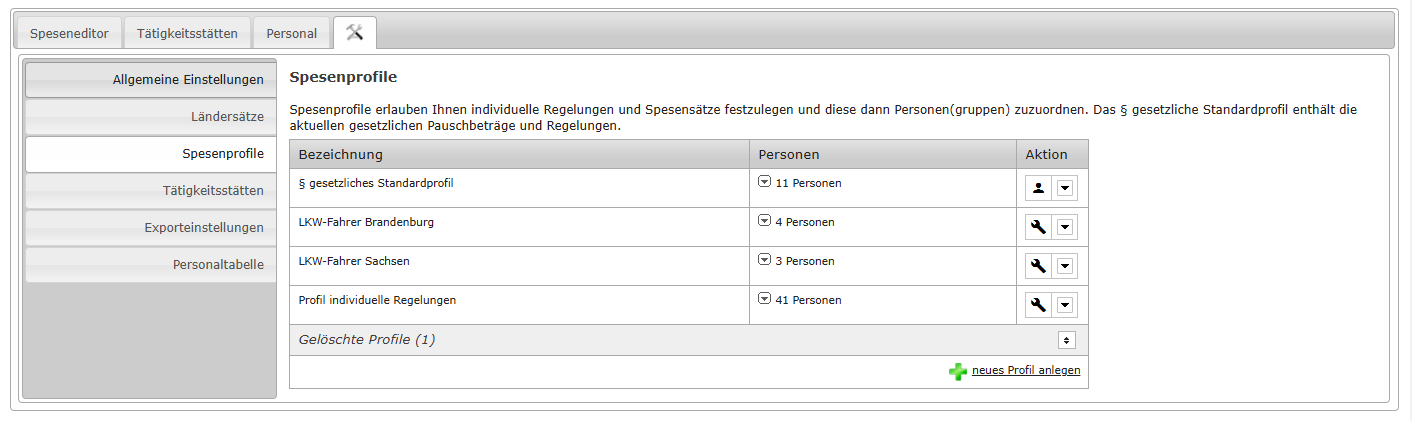

Spesenprofile

Spesenprofile ermöglichen individuelle Spesensätze und Regelungen in einem Profil festzulegen. Alle Fahrer benötigen für die Spesenberechnung zwingend ein Profil.

Übersicht

Im Modul Spesen befindet sich unter Einstellungen der Reiter Spesenprofile. Dort erhalten Sie einen Überblick über alle bestehenden Profile.

Folgendes Profil steht immer zur Verfügung:

- Profil „§ gesetzliches Standardprofil“

- In diesem Profil sind alle gesetzlichen Vorgaben hinterlegt. Es kann nicht verändert werden.

Bestandskunden, deren Einstellung bisher Firmenweit war, erhalten ein weiteres Profil:

- Profil „individuelle Regelungen“

- Alle bisherigen Einstellungen wurden in dieses Profil übertragen.

- Alle Fahrer Ihrer Firma sind diesem Profil zugeordnet.

- Wenn Sie weiterhin nur dieses eine Spesenprofil nutzen wollen, muss nichts weiter vorgenommen werden.

Aktionen

Über das Aktionsmenü können Sie folgende Optionen für das Profil treffen:

- Bearbeiten: Öffnet eine Maske zum Ändern eines bestimmten Spesenprofiles -> siehe Spesenprofil erstellen/bearbeiten

- Personalzuordnung: Bietet eine direkte Möglichkeit ein Profil mehreren Personen gleichzeitig zuzuordnen. Spesenprofile können alternativ auch über die Personalverwaltung einer Person zugewiesen werden.

- Profildetails anzeigen: Öffnet eine Ansicht, mit den zuletzt gültigen Regelungen und einer Historie der Spesensätze.

- Löschen: Das Profil wird deaktiviert. Beim Löschen eines Profils werden alle aktuellen Personalzuweisungen zum Tag vor dem Löschen beendet. Ab dem Tag des Löschens werden diese Zuweisungen automatisch dem „§ gesetzlichen Standardprofil“ zugeordnet.

- Neues Profil anlegen: Öffnet eine Maske zum Erstellen eines neuen Spesenprofiles -> siehe Neues Profil erstellen/Profil bearbeiten

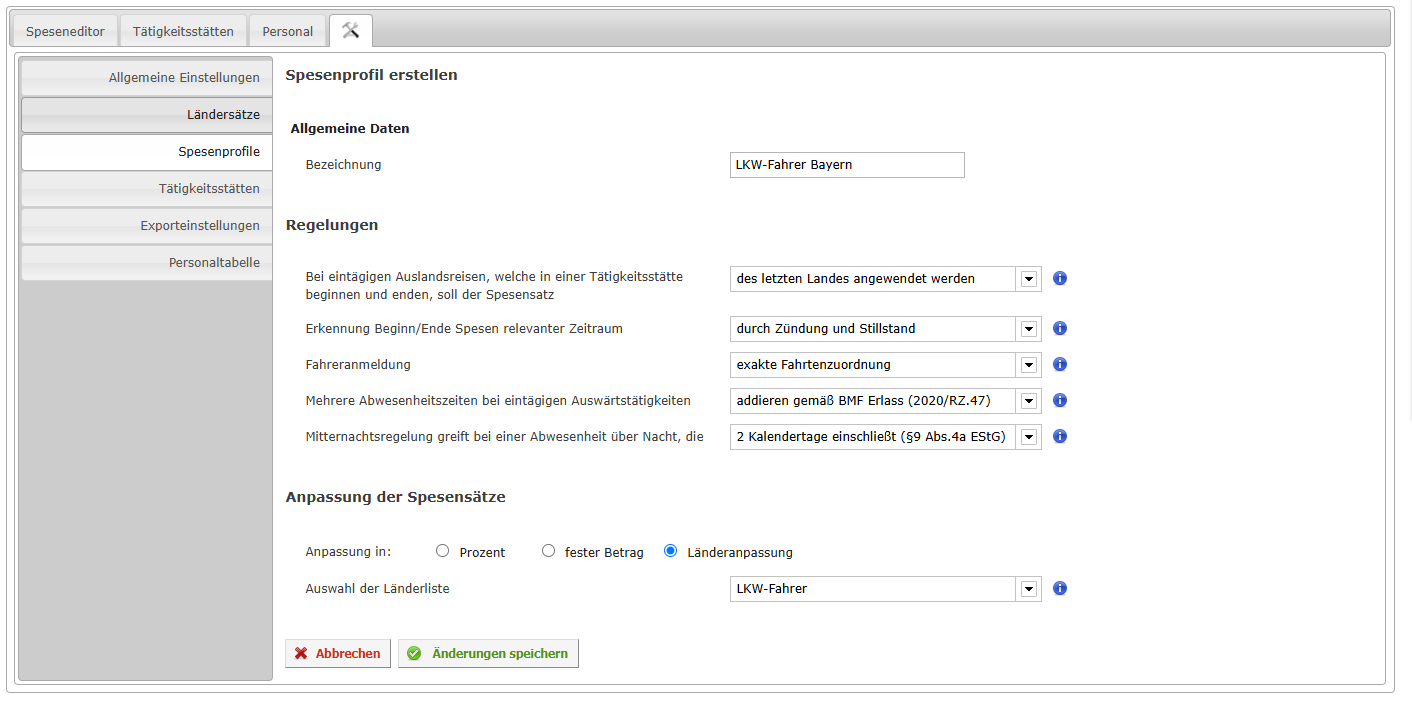

Spesenprofil erstellen/bearbeiten

Falls Sie zusätzliche Profile anlegen möchten, können Sie dies ebenfalls im Reiter Spesenprofile über die Schaltfläche Neues Profil anlegen vornehmen.

Dabei können Sie → Regelungen zur Beurteilung von Abwesenheiten festlegen und definieren Ihre → Spesensätze über die Auswahlfelder Prozent, fester Betrag oder Länderanpassung. Sollte der Wunsch bestehen, weitere Ländersätze zu definieren, kann dies über den Reiter „Ländersätze“ vorgenommen werden.

Wird ein Profil bearbeitet, kann definiert werden, zu welchem Zeitpunkt die Anpassungen gelten sollen. Eine rückwirkende Änderung kann bis zu drei Monate, jeweils zum 1. des Monats, vorgenommen werden. Dabei werden bereits berechnete Spesen für die aktuell zugeordneten Personen zu diesem Profil gelöscht. Eine Neuberechnung erfolgt zeitnah.

Regelungen

Folgende Regelungen können Sie zur Bewertung einer Abwesenheit festlegen:

| Regel | Erläuterung |

|---|---|

| Bei eintägigen Auslandsreisen, welche in einer Tätigkeitsstätte beginnen und enden, soll der Spesensatz | Reist der Arbeitnehmer an einem Tag vom Inland ins Ausland und wieder zurück ins Inland, kann der Arbeitgeber immer den Pauschbetrag für den ausländischen Staat lohnsteuerfrei erstatten, in dem sich dein Arbeitnehmer zuletzt aufgehalten hat. Mit dieser Einstellung können Sie festlegen, ob der Pauschbetrag für den letzten ausländischen Staat oder der Spesensatz der Tätigkeitsstätte der Berechnung zu Grunde gelegt wird. |

| Erkennung Beginn Spesenrelevanter Zeitraum | Die Abwesenheit im Sinne der Spesen beginnt mit dem Verlassen des Bereiches der Tätigkeitsstätte und endet mit dem Befahren dieses Gebietes. Dabei kann der Nutzer zwischen folgenden zwei Modi wählen:

|

| Fahreranmeldung | Um zu erkennen, welche Fahrten für den Fahrer gewertet werden, kann der Nutzer zwischen folgenden zwei Modi wählen:

|

| Mehrere Abwesenheitszeiten bei eintägigen Auswärtstätigkeiten aufaddieren | Eine Abwesenheitszeit beginnt mit dem Verlassen der Tätigkeitsstätte und endet mit dem Befahren dieses Gebietes. Mehrere Abwesenheitszeiten können in Bezug auf eine eintägige Auswärtstätigkeit wie folgt behandelt werden:

|

| Mitternachtsregelung | Die Mitternachtsregelung greift, wenn eine Abwesenheit über Nacht erfolgt und max. 16 Stunden lang ist. Zur Bewertung einer Mitternacht können 2 Modi gewählt werden:

|

Spesensätze festlegen

Im Bereich Anpassung der Spesensätze können Sie individuelle Spesensätze festlegen nach:

- Prozent: die Geldwerte basieren prozentual auf den gesetzlichen Pauschbeträgen. Wird beispielsweise für eine Abwesenheit „> 8 Stunden“ 50% eingestellt, wird diese Abwesenheit mit 7 € für Deutschland (Stand: 2025) ausgewiesen.

- Fester Betrag: die Geldwerte für über 8 Stunden, einer 24 Stunden Abwesenheit und einer Übernachtung können fix und für jedes Land gleichgesetzt werden.

- Länderanpassung: Hier haben Sie die Möglichkeit, eine eigene Länderliste zu auszuwählen. Die Einstellung einer Länderliste finden Sie unter dem Reiter: Ländersätze -> siehe Ländersätze.

Personalzuordnung

Um Personen einem Profil zuzuweisen, gibt es eine eigene Aktion. Unter „Neue Zuweisung“ erfolgt die entsprechende Zuordnung. Über die Gruppenauswahl können Sie auch direkt mehrere Personen auswählen. In dem Bereich „Bestehende Zuweisungen“ erhalten Sie einen Überblick, welche Fahrer bereits diesem Profil zugewiesen sind.

Ländersätze

Es besteht die Möglichkeit über den Einstellungspunkt Ländersätze pro Land/Region eigene Spesensätze zu definieren.

Übersicht

In der Übersicht erhalten alle erstellten Listen für diese Ländersätze. Für die letzten 4 Jahre werden die gesetzlichen Vorgaben mit ausgewiesen.

Funktionen für Listen:

| Funktion | Bedeutung | Bemerkungen |

|---|---|---|

| Listenwerte anzeigen | Öffnet die Einstellungsseite für diese Liste | vergangene Listen können nicht editiert werden, bei Änderungen an der aktuellen Liste wird diese kopiert (und ggf. gelöscht) |

| Liste kopieren | Kopiert eine Liste mit all ihren Werten | |

| Liste löschen | Löschen einer Liste | |

| Neue Liste anlegen | Öffnet die Einstellungsseite für eine neue Liste | Basis einer neuen Liste sind immer die gesetzlichen Pauschbeträge des jeweiligen Jahres der jeweiligen Länder |

Einstellungen

Jede Liste besteht aus einem Bezeichner. Bei einer neuen Liste besteht dazu die Möglichkeit zu definieren, ob diese alle Länder umfassen soll, oder nur die geänderten. Per Standard erhalten sie eine eingeschränkte Liste mit allen Ländern, deren Einstellungen vom Gesetz abweichen. Sie können aber zu einer vollständigen Ansicht umschalten, in der alle Länder/Regionen gelistet und bearbeitet werden können.

Einstellung "Listenumfang"

Der Unterschied ob eine Liste nur geänderte Länder oder alle Länder umfasst ist anfänglich trivial, kann aber später größere Auswirkungen haben.

Umfasst die Liste nur geänderte Länder, werden für alle anderen Länder die gesetzlichen Daten verwendet. Diese werden von YellowFox gepflegt und gewartet. Überschreitet eine Liste die Jahresgrenze und ändern sich ab dem 01.01. eines Jahres gesetzliche Werte, so finden diese automatisch Anwendung.

Eine Liste mit allen Ländern profitiert von diesen Anpassungen nicht, ihre Werte bleiben stabil. Für eine vollständige Liste sind alle Daten festgelegt, wie angegeben. Änderungen an gesetzlichen Daten haben keinen Einfluss auf diese Liste.

Einstellungen anpassen

Sie können für jedes Land/Region auf der Zeitleiste eigenen Zeitpunkte setzen, ab welchen Spesen gezahlt werden sollen. Dazu klicken Sie auf den Zeitpunkt in der Zeitleiste um einen neuen Marker zu setzen, oder verschieben Sie einen der vorhandenen auf den gewünschten Zeitpunkt. Um einen Zeitpunkt zu löschen, markieren Sie diesen (alle weiteren werden ausgeblendet) und klicken Sie auf das

Um die Auswahl eines Markers zurückzunehmen und alle weiteren Marker wieder einzublenden, klicken Sie bitte erneut auf den Marker.

Um den Betrag für einen Zeitpunkt anzupassen, klicken Sie auf den Betrag und ändern diesen. Bei Änderungen am Marker für 24h wird der Betrag für den vollen Spesensatz automatisch angepasst.

Alle Änderungen werden rot markiert.

Möchten Sie die Änderungen zurücknehmen, klicken Sie auf die Aktion  Damit werden alle Daten für dieses Land/Region wieder auf den zuletzt gespeicherten Stand gesetzt. Um zur gesetzlichen Einstellung zurückzukehren nutzen Sie bitte die Aktion

Damit werden alle Daten für dieses Land/Region wieder auf den zuletzt gespeicherten Stand gesetzt. Um zur gesetzlichen Einstellung zurückzukehren nutzen Sie bitte die Aktion

Nach dem Speichern der Daten werden diese abhängig vom Gültigkeitszeitraum zur Berechnung herangezogen.